Are You Wasting Your Efforts on Onsite Surveys?

The WLAN market size is estimated to grow to USD 15.60 Billion by 2022, at a Compound Annual Growth Rate (CAGR) of 21.2%. The major factors driving the Wi-Fi market are growing implementation of BYOD within organizations, increase in demand for wireless and smart devices, and emergence of IoT.

Let us see the current landscape of leading vendors/manufacturers of WLAN devices across the world.

The figure above represents the magic quadrant for Wired and Wireless LAN infrastructure. As we can see Cisco, HPE(Aruba) stand out as the leaders in WLAN. The wireless channel partners are constantly looking to provide the best customer experience using the products from the top vendors.

The advent of IoT, adoption of smart devices, ever increasing usage of Wi-Fi at our homes, businesses, cafes and other public spaces; would need to share the available wireless spectrum effectively to provide connectivity for users. Hence design and maintenance of your Wireless LAN becomes key component in running the daily business needs.

Various approaches to WLAN design have evolved over time. In order to provide a highly robust Wi-FI network with adequate coverage and capacity/bandwidth to serve the users, a site survey is necessary.

There are broadly three types of WLAN site surveys:

Passive Onsite Survey – In this type of site survey, temporary hardware equipment (typically a wireless adapter and one or more Access Points) is used to gauge the RF environment. The adapter without being associated to the APs detects the RF characteristics like Active APs, signal strength (RSSI) and noise levels (SNR) etc. This requires an RF Engineer to visit the site and take measurements

Active Onsite Survey – In this the adapter is associated with one or more access points to measure other detailed RF characteristics like round-trip time, throughput rates, packet loss, and retransmissions. Active surveys are used to troubleshoot Wi-Fi networks or to verify performance post-deployment. This also requires an RF Engineer to visit the site and take measurements.

Predictive Site Survey– In this type of survey, a model is created using data obtained from the actual Access Points and a simulation of customer’s RF environment is created. This provides a great flexibility and account for the coverage area, walls (signal attenuation provided by different wall types), and any other sources of signal interference to finally arrive at an estimated number of Access Points required.

In this type of survey, a model is created using data obtained from the actual Access Points and a simulation of customer’s RF environment is created

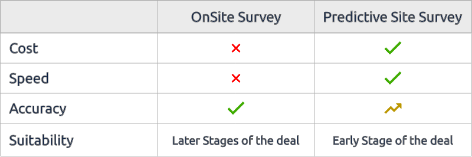

Let us take a quick look at how these stack up w.r.t one another in terms of utility and pricing:

Why conduct onsite survey when as a partner you are not sure if you will win the deal in the end. Predictive Site Survey can help partners save their efforts especially in the early part of the deals by engaging with the customer with the predictive analysis of the customer environment.

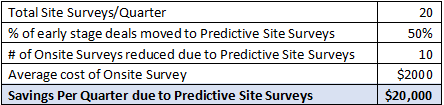

Let’s see an example:

As shown in this example, by reducing the number of early stage deals to Predictive Site Surveys, your overall savings increased as the cost spend on Onsite Surveys is saved.

Predictive Site Survey Planner can help partners in

- Conducting lesser onsite surveys, hence reducing the time and costs associated with it.

- Increase in Productivity, better collaboration amongst the team and easier management of various versions of designs.

Take a look at your return of investment on a Predictive Site Survey Planner like Yagna iQ’s RF Wi-Fi Planner here

Get ready to capture your savings.

Happy Wireless Planning!